A Comprehensive Guide to Education Loans in Sri Lanka: Solutions for Your Higher Education Finance Challenges

Pursuing higher education is a dream for many Sri Lankan students. However, the financial burden of tuition fees, living expenses, and other costs often becomes a significant challenge for families. Education loans provide a lifeline for students aspiring to study locally or abroad, but navigating this process can be overwhelming. This article serves as a guide to understanding education loans in Sri Lanka and offers practical solutions for higher education finance issues.

How to Apply for an Education Loan in Sri Lanka

Step 1: Choose the Right Bank or Institution Several banks and financial institutions in Sri Lanka, including Bank of Ceylon, People’s Bank, Commercial Bank, and HNB, offer education loans with varying terms. Research and compare interest rates, repayment options, and loan terms to select the best option for your needs.

Step 2: Understand Eligibility Criteria Most education loans require the applicant to be a Sri Lankan citizen aged 18 to 55. You will also need proof of admission to a recognized educational institution. A guarantor, such as a parent or guardian, is often required to ensure loan security.

Step 3: Submit Your Loan Application Visit the chosen bank or financial institution and complete the loan application process. Be prepared to submit required documents and, if necessary, provide collateral to secure the loan.

Step 4: Loan Approval and Disbursement Once approved, the loan amount will be disbursed directly to the educational institution or as agreed with the bank.

Documents Required for an Education Loan

Here are the key documents you’ll need to apply for an education loan:

- Personal Documents

- National Identity Card (NIC) or passport

- Birth certificate

- Recent passport-sized photographs

- Academic Documents

- Admission letter from the educational institution

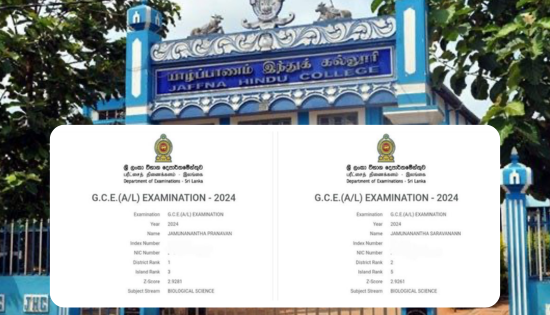

- Educational certificates (e.g., GCE O/L and A/L results)

- Financial Documents

- Bank statements (applicant or guarantor)

- Salary slips or proof of income

- Tax documents (if applicable)

- Guarantor or Collateral Documents

- Guarantor’s NIC, proof of income, and consent letter

- Property documents (if collateral is required)

Related News

Sirus Migration Announces Exclusive New Zealand and Australia Migration Events in Sri Lanka this July

The team at Sirus Migration Sirus Migration Education, a leading Australia based migration and education consultancy, has announced its upcoming two week…

Read MoreStudy English Language and Literature at CINEC

The Bachelor of Arts in English program at CINEC Campus is designed to equip students with strong competencies in English language, literature,…

Read MoreMaster Employment Law with the CIPM Executive Certificate

The Executive Certificate in Employment Law (ECEL) from CIPM Sri Lanka is a specialized three-month online program designed for HR professionals, managers,…

Read MoreSerendib Flour Mills celebrates World Environment Day with school tree planting initiative

-Nourishing the Nation, Nurturing the Earth- Demonstrating a long-term dedication to environmental sustainability, and in celebration of World Environment Day 2025, Serendib…

Read MoreBLAZE by Imperial College set to ignite the spirit of university sports

Imperial College of Business Studies is continuing its 40th anniversary celebrations by unveiling BLAZE 2025, a “fresh, fierce, and unforgettable” event that…

Read MoreCourses

-

IMC – Bachelor of Psychology

IMC Education Overview IMC Campus in partnership with Lincoln University College (LUC) Malaysia offers Bachelor of Psychology Degree right here in Sri… -

ANC – BA (Hons) International Business Management (Top-Up)

ANC Education Overview Designed in partnership with public and private business organizations, this program develops one’s ability to critically evaluate business models… -

IIT – BSc (Hons) Computer Science

IIT Campus Overview BSc (Hons) Computer Science provides a solid foundation and training regarding the fundamentals of the computer science field, along… -

APIIT – BSc (Hons) Cyber Security

APIIT Sri Lanka Overview Our BSc (Hons) Cyber Security award is designed to launch your future career in the protection of software… -

ICBS – BSC (Hons) Business Management with Marketing Management

ICBS Overview The BSc (Hons) Business Management with Marketing program, awarded by Queen Margaret University (QMU), is a highly regarded degree that… -

UTS – Diploma of Science

UTS College Sri Lanka Overview The Diploma of Science is designed to empower you to apply scientific thinking and analysis to important… -

CSA – Master of Architecture and Environmental Design

City School of Architecture Overview The Master of Architecture and Environmental Design Degree at CSA is awarded by the University of the… -

APIIT – BSc (Hons) International Business Management

APIIT Sri Lanka Overview Increasingly businesses are becoming more and more international. This requires business management professionals to have knowledge, skills and… -

IIT – BSc (Hons) Artificial Intelligence And Data Science

IIT Campus Overview The BSc (Hons) Artificial Intelligence and Data Science course is awarded by Robert Gordon University (RGU) in the UK… -

ICBS – International Degree Foundation in Business / IT

ICBS Overview The Scottish Qualification Authority (SQA) is a globally recognized organization dedicated to education and qualification development. SQA is responsible for… -

APIIT – BA (Hons) Finance and Business Enterprise

APIIT Sri Lanka Overview Finance and accounting are no longer just about taxation and the management of financial capital. This award will… -

APIIT – MBA General

APIIT Sri Lanka Overview The MBA is awarded by Staffordshire University, UK. This award is an advanced course of study in management… -

ANC – LLM in International Business & Commercial Law

ANC Education Overview This course is designed for graduates of law, business and finance in a legal or a corporate job role… -

AOD – BA (Hons) Fashion Design and Marketing

Academy of Design Overview The syllabus is from the UK’s Northumbria University, as one of their most revered flagship programmes and is… -

APIIT – MSc. Marketing Management

APIIT Sri Lanka Overview This MSc Marketing Management degree – awarded by Staffordshire University, UK is an advanced course of study in…

Newswire

-

IMF has approved the 4th review of Sri Lanka’s program

ON: July 1, 2025 -

Major push to upgrade Helmet Standards in Sri Lanka

ON: July 1, 2025